Super Micro Computer Inc (SMCI) Exceeds Analyst Estimates with Strong Q3 Fiscal 2024 Results

Revenue: Reported $3.85 billion, marking a substantial increase from $1.28 billion in the same quarter last year, and surpassing the estimated $3.989 billion.

Net Income: Achieved $402 million, significantly higher than the previous year's $86 million and exceeded the estimate of $352.38 million.

Earnings Per Share (EPS): Diluted EPS stood at $6.56, compared to $1.53 year-over-year, exceeding the estimated $5.84.

Gross Margin: Recorded at 15.5%, slightly down from 17.6% in the same quarter of the previous year.

Operating Cash Flow: Cash flow used in operations reached $1,520 million for the quarter.

Future Outlook: Raised fiscal year 2024 revenue projections to $14.7 billion to $15.1 billion, indicating strong future performance expectations.

Stock Performance: Non-GAAP diluted net income per common share was $6.65, reflecting robust profitability and operational efficiency.

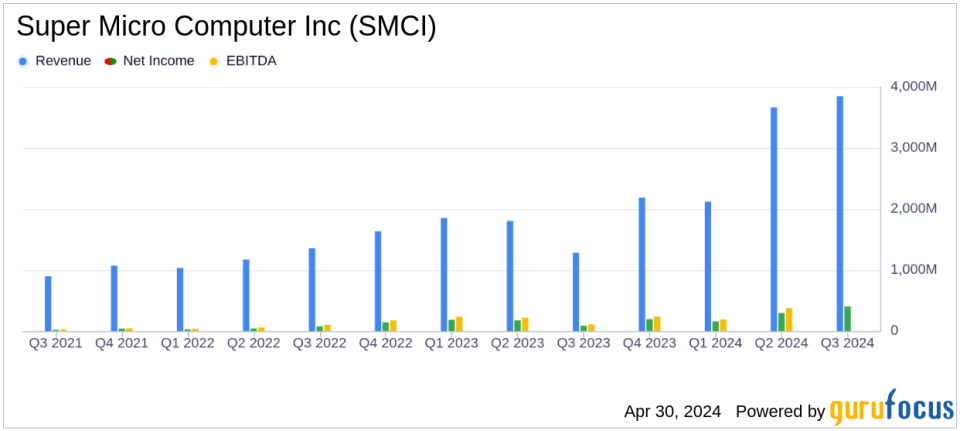

On April 30, 2024, Super Micro Computer Inc (NASDAQ:SMCI), a leader in AI, Cloud, Storage, and 5G/Edge IT solutions, disclosed its financial outcomes for the third quarter of fiscal year 2024, as detailed in its 8-K filing. The company reported significant growth, with net sales reaching $3.85 billion, up from $3.66 billion in the previous quarter and a substantial increase from $1.28 billion in the same quarter last year. This performance notably surpassed the analyst estimates of $3.989 billion in revenue.

Super Micro Computer Inc, headquartered in San Jose, California, specializes in providing high-performance server technology services. The company's innovative solutions cater to a range of markets including cloud computing, data centers, and high-performance computing. Its modular architectural approach allows flexibility in delivering tailored solutions, with a significant portion of its revenue generated in the United States.

Financial Highlights and Performance Analysis

The company's net income for the quarter was an impressive $402 million, a stark increase from $296 million in the preceding quarter and $86 million in the same quarter of the previous year. This figure comfortably exceeded the estimated net income of $352.38 million. Earnings per share (EPS) also outperformed expectations, with a reported EPS of $6.56 against an estimated $5.84.

Super Micro's gross margin for the quarter stood at 15.5%, slightly higher than the 15.4% in the second quarter but lower than the 17.6% from the same period last year. The company's operational efficiency and strategic initiatives have played a crucial role in maintaining profitability amidst varying market conditions.

The balance sheet remains robust with total assets amounting to $8.86 billion as of March 31, 2024, significantly higher than the $3.67 billion from the previous year. This increase is supported by a strong cash position of $2.12 billion, up from $440 million, showcasing the company's solid liquidity and financial health.

Strategic Moves and Future Outlook

Charles Liang, President and CEO of Supermicro, commented on the results, stating, "We had yet another record quarter with fiscal Q3 revenue of $3.85 billion with non-GAAP EPS of $6.65 per share. This year-over-year revenue growth of 200% and year-over-year non-GAAP EPS growth of 308% was well above our industry peers." He also highlighted the strong demand for AI rack scale PnP solutions and innovative DLC designs as key drivers of the company's market leadership expansion in AI infrastructure.

Looking ahead, Supermicro has raised its revenue outlook for fiscal year 2024 from $14.3 billion to a range of $14.7 to $15.1 billion. The company also anticipates fourth-quarter net sales to be between $5.1 billion and $5.5 billion, with GAAP net income per diluted share expected to range from $7.20 to $8.05 and non-GAAP net income per diluted share projected between $7.62 and $8.42.

This financial performance and optimistic outlook reflect Super Micro Computer Inc's strong market position and its ability to adapt and innovate in a dynamic industry environment. Investors and stakeholders may look forward to continued growth and profitability as the company leverages its strengths in high-performance computing and server solutions.

Explore the complete 8-K earnings release (here) from Super Micro Computer Inc for further details.

This article first appeared on GuruFocus.

Yahoo Finanzen

Yahoo Finanzen