Price & Time: Waiting For Follow-Through in EUR/USD

DailyFX.com -

Talking Points

Downtrend trying to re-emerge in EUR/USD?

USD/JPY holds key Gann level

AUD/USD fails near key resistance

Get real time volume on your charts for free. Click HERE

Foreign Exchange Price & Time at a Glance:

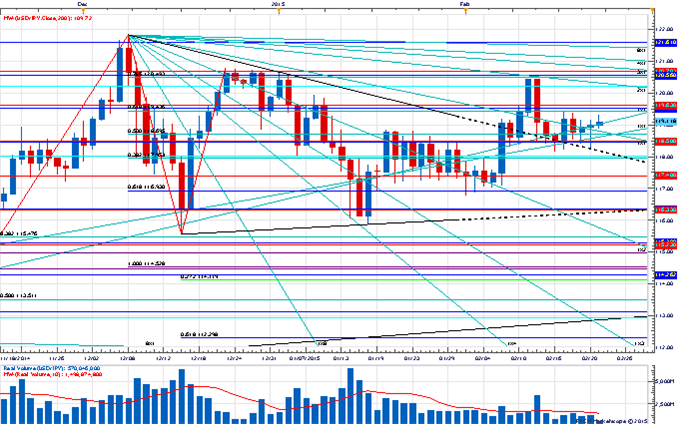

Price & Time Analysis: USD/JPY

Charts Created using Marketscope – Prepared by Kristian Kerr

USD/JPY remains in consolidation mode above the 3rd square root relationship of the 2014 high near 118.40

Our near-term trend bias remains positive while above 118.40

Interim resistance is seen around 119.65, but a move through 120.80 is really needed to signal that a more meaningful extension higher is underway

A very minor turn window is eyed tomorrow

A close below 118.40 would turn us negative on the exchange rate

USD/JPY Strategy: Like the long side while 118.40 holds.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

USD/JPY | 117.95 | *118.40 | 119.10 | 119.65 | *120.80 |

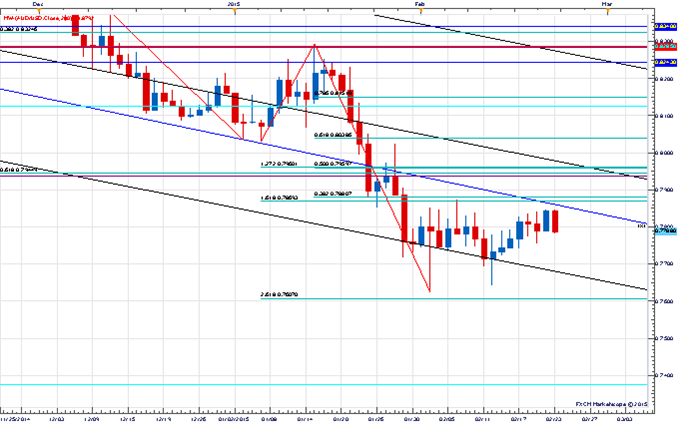

Price & Time Analysis: AUD/USD

Charts Created using Marketscope – Prepared by Kristian Kerr

AUD/USD remains in consolidation mode below the 3rd square root relationship of the year’s low near .7885

Our near-term trend bias is negative while below .7885

The year’s closing low around .7715 remains a key downside pivot with weakness below needed to signal a resumption of the broader trend

A minor turn window is eyed mid-week

A close above .7885 would turn us positive on the Aussie

AUD/USD Strategy: Like the short side while below .7885.

Instrument | Support 2 | Support 1 | Spot | Resistance 1 | Resistance 2 |

AUD/USD | *.7715 | .7760 | .7790 | .7840 | *.7885 |

Focus Chart of the Day: EUR/USD

Choppy trade continues in EUR/USD. The pair did stall out during the key cyclical period we highlighted around the middle of last week, but so far declines have been held in check by Gann support around 1.1270. A clear break of this level is desperately needed to signal that the broader downtrend is indeed trying to re-assert itself. The 61.8% retracement of the all-time low and all-time high around 1.1210 is also key in this regard. Last week’s highs around 1.1450 should not be breached if the downtrend is resuming like we suspect, but it would really take a push through 1.1515 to signal that a more important move higher in the euro is unfolding.

To receive Kristian’s analysis directly via email, please SIGN UP HERE.

This publication attempts to further explore the concept that mass movements of human psychology, as represented by the financial markets, are subject to the mathematical laws of nature and through the use of various geometric, arithmetic, statistical and cyclical techniques a better understanding of markets and their corresponding movements can be achieved.

--- Written by Kristian Kerr, Senior Currency Strategist for DailyFX.com

To contact Kristian, e-mail kkerr@fxcm.com. Follow me on Twitter @KKerrFX

DailyFX provides forex news and technical analysis on the trends that influence the global currency markets.

Learn forex trading with a free practice account and trading charts from FXCM.

Yahoo Finanzen

Yahoo Finanzen