June 2024 Insight Into KRX Growth Companies With High Insider Ownership

The South Korean stock market has recently shown resilience, rebounding from a two-day slide and settling just below the 2,775-point plateau. Amidst this backdrop of modest gains and sector-specific fluctuations, investors might find particular interest in growth companies with high insider ownership, which can signal strong confidence in the company's future from those who know it best. In current conditions where technology shares provide support against broader market weaknesses, such firms could represent compelling considerations.

Top 10 Growth Companies With High Insider Ownership In South Korea

Name | Insider Ownership | Earnings Growth |

ALTEOGEN (KOSDAQ:A196170) | 26.6% | 73.1% |

Fine M-TecLTD (KOSDAQ:A441270) | 17.3% | 36.4% |

Global Tax Free (KOSDAQ:A204620) | 18.1% | 72.4% |

HANA Micron (KOSDAQ:A067310) | 20% | 93.4% |

Park Systems (KOSDAQ:A140860) | 33.1% | 35.9% |

UTI (KOSDAQ:A179900) | 34.1% | 122.7% |

Seojin SystemLtd (KOSDAQ:A178320) | 26.4% | 48.1% |

Devsisters (KOSDAQ:A194480) | 26.7% | 67.5% |

INTEKPLUS (KOSDAQ:A064290) | 16.3% | 77.4% |

Techwing (KOSDAQ:A089030) | 18.7% | 118.2% |

Here's a peek at a few of the choices from the screener.

Medy-Tox

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Medy-Tox Inc. is a biopharmaceutical company based in South Korea, with a market capitalization of approximately ₩974.54 billion.

Operations: The company operates primarily in the biopharmaceutical sector in South Korea.

Insider Ownership: 19.7%

Earnings Growth Forecast: 72.2% p.a.

Medy-Tox, a South Korean company with significant insider ownership, faces challenges despite its strong growth potential. The company's earnings are expected to grow by 72.24% annually, outpacing the market forecast of 29%. However, its recent financial performance shows a substantial net loss of KRW 1.47 billion in Q1 2024 and a dramatic drop in sales from the previous year. Additionally, Medy-Tox trades at 63.9% below its estimated fair value, indicating potential undervaluation amidst these challenges.

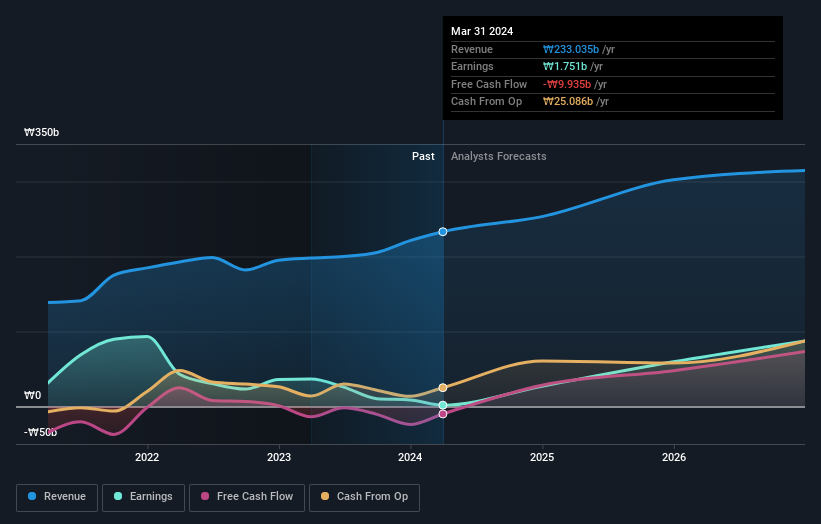

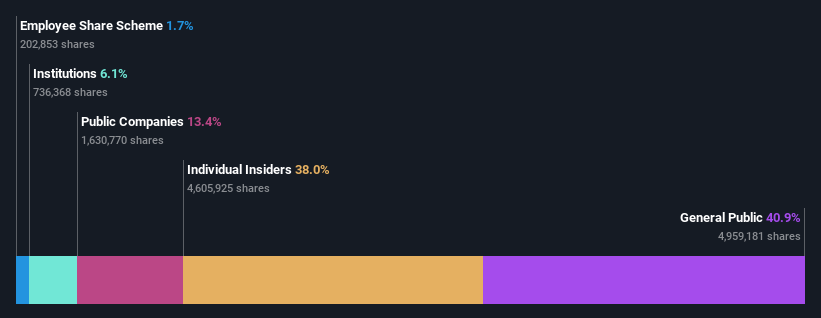

SungEel HiTech

Simply Wall St Growth Rating: ★★★★★☆

Overview: SungEel HiTech Co., Ltd. specializes in recycling secondary batteries and operates out of South Korea, with a market capitalization of approximately ₩934.40 billion.

Operations: The company generates its revenue primarily through the recycling of secondary batteries.

Insider Ownership: 38%

Earnings Growth Forecast: 84.2% p.a.

SungEel HiTech, a South Korean growth company with high insider ownership, is poised for robust expansion with earnings expected to surge by 84.2% annually over the next three years, significantly outpacing the market's 29%. Revenue forecasts are similarly strong at 34% annual growth. Despite these positives, challenges include a low forecasted return on equity of 10% and poor debt coverage by operating cash flow. Additionally, recent activities include a KRW 50 billion private placement aimed at funding further expansion.

Click to explore a detailed breakdown of our findings in SungEel HiTech's earnings growth report.

Upon reviewing our latest valuation report, SungEel HiTech's share price might be too optimistic.

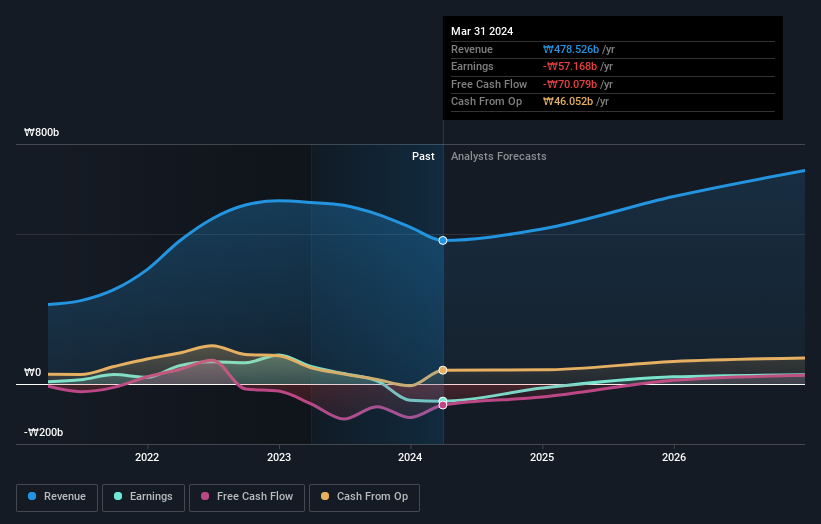

Foosung

Simply Wall St Growth Rating: ★★★★☆☆

Overview: Foosung Co., Ltd. specializes in the production and distribution of chemical products for various industries including automotive, iron and steel, semiconductor, construction, and environmental sectors in South Korea, with a market capitalization of approximately ₩777.60 billion.

Operations: The company generates revenue through the production and sale of chemical products, primarily serving the automotive, iron and steel, semiconductor, construction, and environmental sectors.

Insider Ownership: 32.9%

Earnings Growth Forecast: 73.7% p.a.

Foosung, a South Korean company with significant insider ownership, is anticipated to see revenue growth of 13.8% annually, surpassing the national market's 10.5%. While not reaching the high growth benchmark of 20%, its earnings could grow by an impressive 73.65% per year. However, challenges such as shareholder dilution and inadequate debt coverage by operating cash flow are concerns. Recently, Foosung raised KRW 82.72 billion through a follow-on equity offering to support its operations and expansion plans.

Navigate through the intricacies of Foosung with our comprehensive analyst estimates report here.

Our expertly prepared valuation report Foosung implies its share price may be too high.

Seize The Opportunity

Gain an insight into the universe of 85 Fast Growing KRX Companies With High Insider Ownership by clicking here.

Hold shares in these firms? Setup your portfolio in Simply Wall St to seamlessly track your investments and receive personalized updates on your portfolio's performance.

Invest smarter with the free Simply Wall St app providing detailed insights into every stock market around the globe.

Interested In Other Possibilities?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Diversify your portfolio with solid dividend payers offering reliable income streams to weather potential market turbulence.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.The analysis only considers stock directly held by insiders. It does not include indirectly owned stock through other vehicles such as corporate and/or trust entities. All forecast revenue and earnings growth rates quoted are in terms of annualised (per annum) growth rates over 1-3 years.

Companies discussed in this article include KOSDAQ:A086900 KOSDAQ:A365340 and KOSE:A093370.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finanzen

Yahoo Finanzen