Brooks Macdonald Group And Two Other Top Dividend Stocks In The UK

Amid fluctuating global markets and cautious investor sentiment, the United Kingdom's financial landscape remains a point of focus, particularly as the FTSE 100 shows resilience in uncertain times. In this environment, understanding the characteristics of strong dividend stocks becomes crucial for those looking to add stability and potential income to their portfolios.

Top 10 Dividend Stocks In The United Kingdom

Name | Dividend Yield | Dividend Rating |

Record (LSE:REC) | 8.12% | ★★★★★★ |

Keller Group (LSE:KLR) | 3.69% | ★★★★★☆ |

Impax Asset Management Group (AIM:IPX) | 7.15% | ★★★★★☆ |

DCC (LSE:DCC) | 3.55% | ★★★★★☆ |

Dunelm Group (LSE:DNLM) | 7.22% | ★★★★★☆ |

Plus500 (LSE:PLUS) | 5.85% | ★★★★★☆ |

Big Yellow Group (LSE:BYG) | 3.80% | ★★★★★☆ |

Grafton Group (LSE:GFTU) | 3.80% | ★★★★★☆ |

Rio Tinto Group (LSE:RIO) | 6.34% | ★★★★★☆ |

Hargreaves Services (AIM:HSP) | 6.74% | ★★★★★☆ |

Click here to see the full list of 58 stocks from our Top Dividend Stocks screener.

Here's a peek at a few of the choices from the screener.

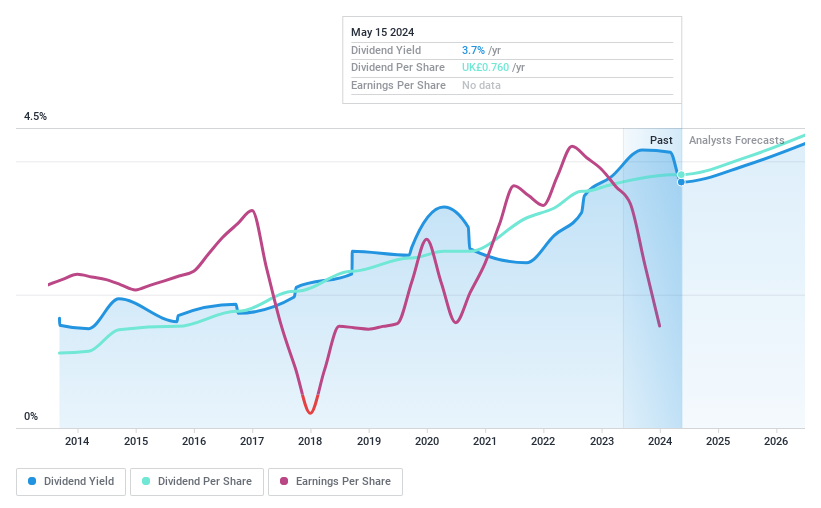

Brooks Macdonald Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Brooks Macdonald Group plc offers investment and wealth management services to private clients, pension funds, professional intermediaries, and trustees primarily in the UK, Isle of Man, and Channel Islands, with a market capitalization of approximately £318.88 million.

Operations: Brooks Macdonald Group plc generates £19.62 million in revenue from its international operations.

Dividend Yield: 3.8%

Brooks Macdonald Group's dividend yield stands at 3.8%, which is lower than the top quartile of UK dividend payers. Despite a history of stable dividends over the past decade, payments are not well-supported by earnings, with a high payout ratio of 162.6%. However, cash flows more adequately cover dividends, evidenced by a cash payout ratio of 34.2%. Recent executive changes include Andrea Montague's upcoming CEO role from October 2024, succeeding Andrew Shepherd.

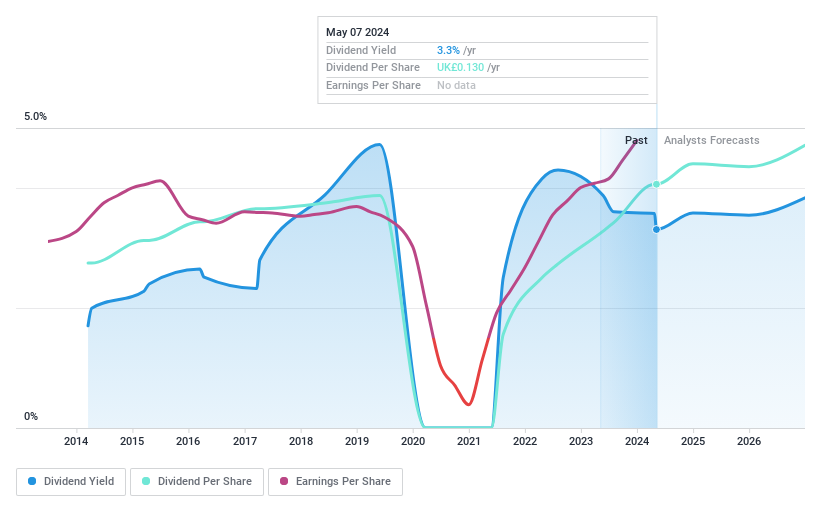

Mears Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Mears Group plc operates in the United Kingdom, offering a range of outsourced services to both public and private sectors, with a market capitalization of approximately £352.44 million.

Operations: Mears Group plc generates revenue through three primary segments: Management (£543.35 million), Development (£2.70 million), and Maintenance (£543.28 million).

Dividend Yield: 3.5%

Mears Group's recent dividend increase to 13.00 pence for FY2023, up from 10.50 pence the previous year, reflects a positive cash performance and management confidence. Despite this growth, the dividend yield of 3.55% remains below the UK market's top quartile at 5.61%. The dividends are well-supported by both earnings and cash flows with payout ratios of 39.5% and 11.4%, respectively; however, Mears has exhibited an unstable dividend track record over the last decade.

Dive into the specifics of Mears Group here with our thorough dividend report.

Upon reviewing our latest valuation report, Mears Group's share price might be too pessimistic.

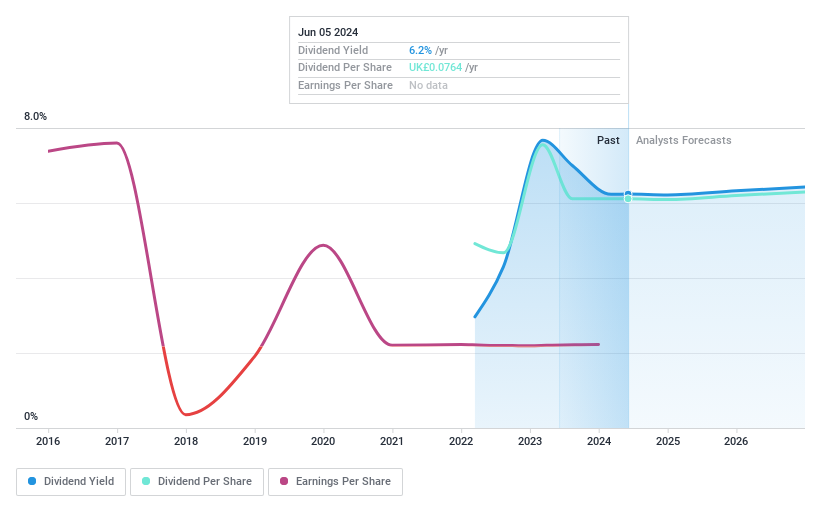

Stelrad Group

Simply Wall St Dividend Rating: ★★★★☆☆

Overview: Stelrad Group PLC is a company that manufactures and distributes radiators across the UK, Ireland, Europe, Turkey, and other international markets, with a market capitalization of approximately £143.27 million.

Operations: Stelrad Group PLC generates £308.19 million in revenue from its core business of radiator manufacturing and distribution.

Dividend Yield: 6.8%

Stelrad Group PLC offers a competitive dividend yield of 6.79%, ranking in the upper quartile of UK dividend payers. Despite a short history of dividends with only 2 years of payments, recent increases signal potential commitment to shareholder returns. However, dividends have shown volatility and the company's financial management is undergoing transition, with CFO Annette Borén stepping down soon. Trading at 41.8% below estimated fair value and analysts predicting significant price growth, Stelrad presents both opportunities and risks for dividend-focused portfolios.

Next Steps

Click through to start exploring the rest of the 55 Top Dividend Stocks now.

Are you invested in these stocks already? Keep abreast of every twist and turn by setting up a portfolio with Simply Wall St, where we make it simple for investors like you to stay informed and proactive.

Simply Wall St is a revolutionary app designed for long-term stock investors, it's free and covers every market in the world.

Ready For A Different Approach?

Explore high-performing small cap companies that haven't yet garnered significant analyst attention.

Fuel your portfolio with companies showing strong growth potential, backed by optimistic outlooks both from analysts and management.

Find companies with promising cash flow potential yet trading below their fair value.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Companies discussed in this article include AIM:BRK LSE:MER and LSE:SRAD.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team@simplywallst.com

Yahoo Finanzen

Yahoo Finanzen