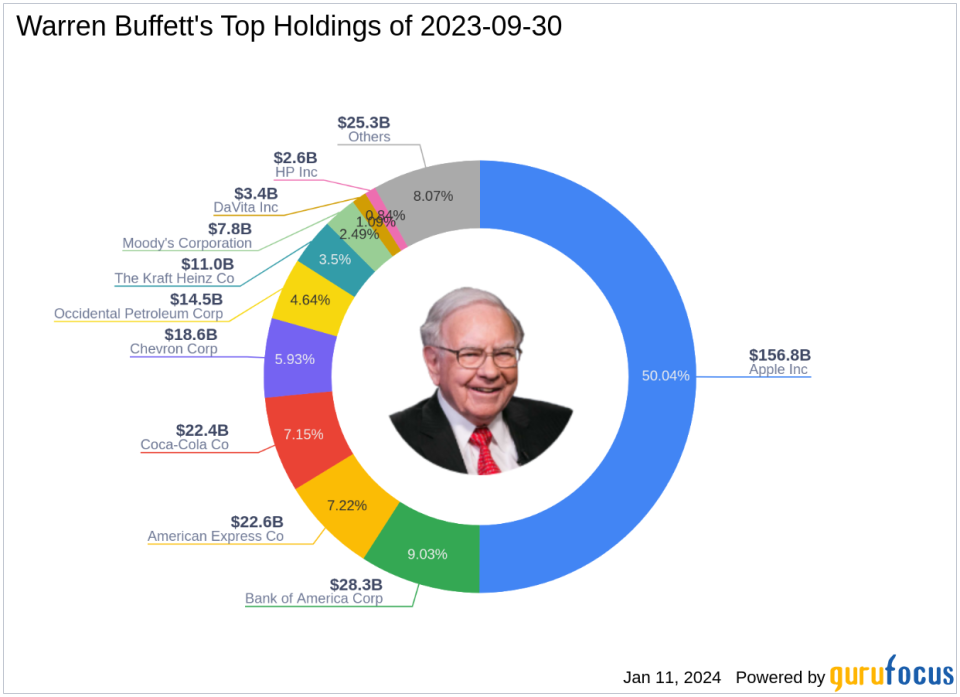

Warren Buffett's Berkshire Bolsters Stake in Occidental Petroleum Corp

On the last day of 2023, Warren Buffett (Trades, Portfolio)'s Berkshire Hathaway made a significant addition to its holdings in Occidental Petroleum Corp (NYSE:OXY), a move that has caught the attention of investors and market analysts alike. The transaction involved the acquisition of 83,858,848 shares, which increased Berkshire Hathaway's total share count in OXY to 327,574,652. This trade, executed at a price of $59.71 per share, had a notable impact of 1.57% on the portfolio, and it adjusted Berkshire's overall position in the company to a commanding 34.00%.

Warren Buffett (Trades, Portfolio): The Legendary Investor

Warren Buffett (Trades, Portfolio), often referred to as "The Oracle of Omaha," is a towering figure in the investment world. His firm, Berkshire Hathaway, has been transformed from a textile manufacturer into a behemoth with a diverse portfolio of businesses and investments. Buffett's value investing strategy, which he honed under the tutelage of Benjamin Graham, focuses on finding undervalued companies with strong long-term prospects, competent management, and attractive prices. This philosophy has consistently outperformed the market, making Buffett one of the most followed investors globally.

Occidental Petroleum Corp: An Energy Powerhouse

Occidental Petroleum Corp, trading under the symbol OXY in the United States since its IPO on May 22, 1986, is an independent oil and gas exploration and production company. With a strong presence in the United States, Latin America, and the Middle East, OXY ended 2022 with 3.8 billion barrels of oil equivalent in net proved reserves. The company's operations are segmented into Chemical, Corporate and eliminations, Midstream and marketing, and Oil and gas, reflecting a diversified approach within the energy sector.

Significance of Buffett's Trade in OXY

The recent trade by Warren Buffett (Trades, Portfolio) has increased Berkshire Hathaway's stake in Occidental Petroleum to a significant 6.15% of the portfolio. This move not only underscores the confidence Buffett has in OXY but also has a substantial impact on the company's ownership structure, with Berkshire now holding a 34.00% share of the company. This level of investment indicates a strong belief in the company's value and future prospects.

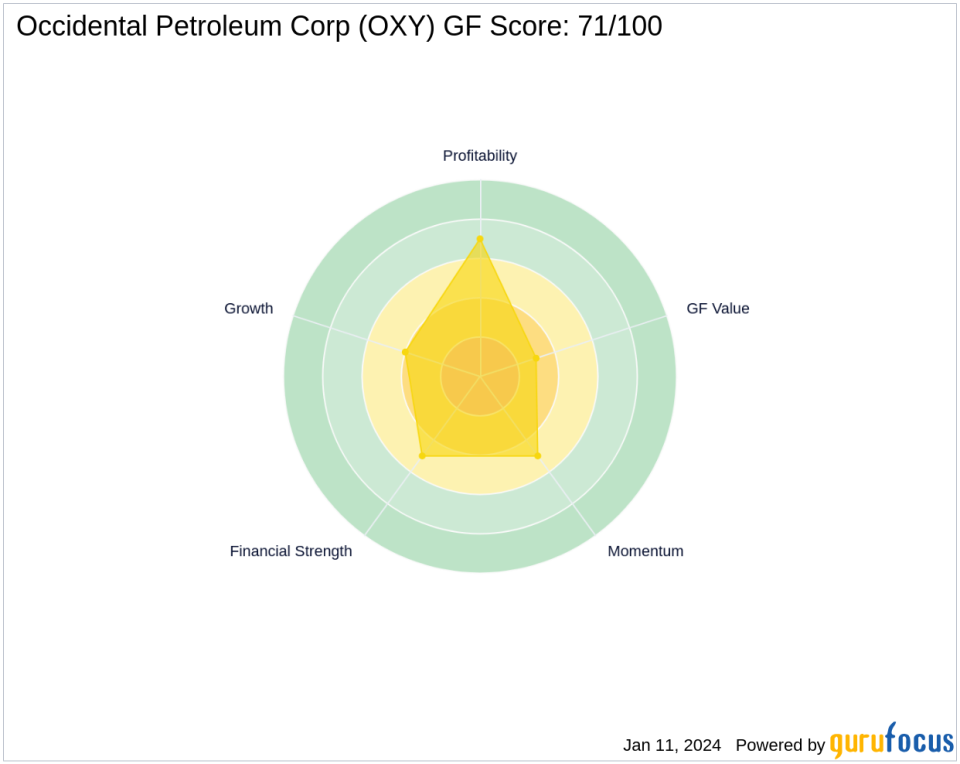

Occidental Petroleum's Financial Overview

Occidental Petroleum currently boasts a market capitalization of $49.85 billion, with a stock price of $56.80. The company's PE ratio stands at 12.43, indicating profitability, although the stock is considered modestly overvalued with a price to GF Value ratio of 1.13. Since Buffett's acquisition, the stock has seen a decline of 4.87%, with a year-to-date performance also in the negative at -5.41%. However, since its IPO, OXY's stock price has surged by 886.11%.

Performance and Industry Context

Occidental Petroleum's GF Score of 71/100 suggests a likely average performance in the future. The company's financial strength and balance sheet rank at 5/10, while its profitability rank is higher at 7/10. The growth rank and GF Value rank are lower at 4/10 and 3/10, respectively. In the broader market, Buffett's top sector holdings are in technology and financial services, but his investment in OXY highlights the significance of the oil & gas industry within his portfolio.

Other Notable Investors in Occidental Petroleum

Buffett is not the only guru with a stake in Occidental Petroleum. Other notable investors include Dodge & Cox, Smead Value Fund (Trades, Portfolio), and Prem Watsa (Trades, Portfolio). However, Berkshire Hathaway remains the largest shareholder, with a dominant share percentage that far exceeds other investors.

Transaction Analysis and Impact

Warren Buffett (Trades, Portfolio)'s latest investment in Occidental Petroleum is a testament to his confidence in the energy sector and his commitment to value investing. The substantial increase in Berkshire Hathaway's holdings in OXY not only affects the company's shareholder structure but also signals to the market that Buffett sees long-term potential in the company's operations and financial health. As investors and analysts watch closely, this move may influence the stock's performance and investor sentiment in the coming months.

This article, generated by GuruFocus, is designed to provide general insights and is not tailored financial advice. Our commentary is rooted in historical data and analyst projections, utilizing an impartial methodology, and is not intended to serve as specific investment guidance. It does not formulate a recommendation to purchase or divest any stock and does not consider individual investment objectives or financial circumstances. Our objective is to deliver long-term, fundamental data-driven analysis. Be aware that our analysis might not incorporate the most recent, price-sensitive company announcements or qualitative information. GuruFocus holds no position in the stocks mentioned herein.

This article first appeared on GuruFocus.

Yahoo Finanzen

Yahoo Finanzen