Alkermes' Innovations Are Transforming Mental Health Treatments

Alkermes PLC (NASDAQ:ALKS) is a fast-growing pharmaceutical company headquartered in Dublin, Ireland.

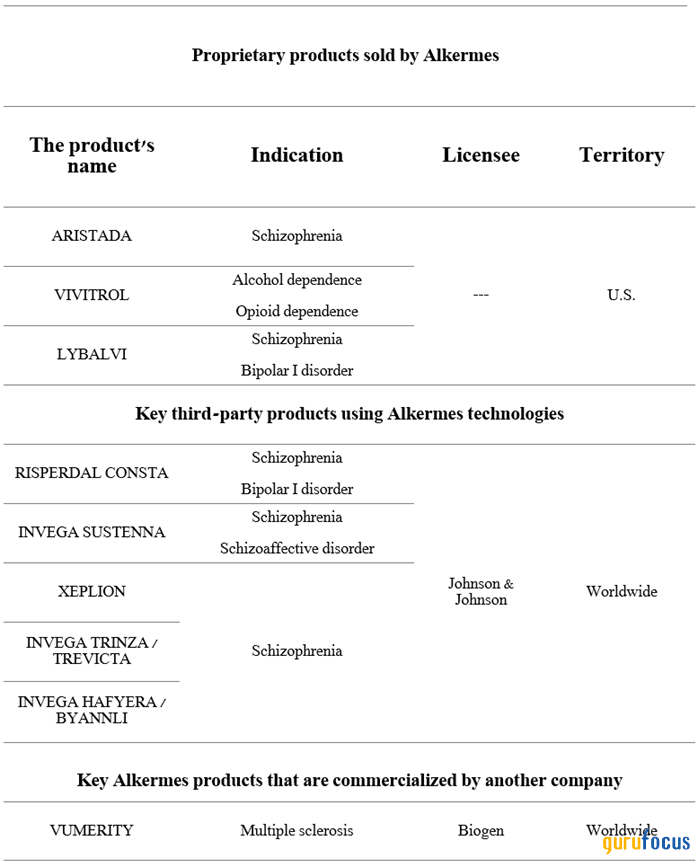

Not only does the company have an extensive pipeline of product candidates being developed using breakthrough technologies such as LinkeRx and NanoCrystal, but it also has a rich portfolio of Food and Drug Administraton-approved drugs that hold leading positions in the fast-growing global schizophrenia and bipolar disorder therapeutics markets. Ultimately, this is reflected in the company's double-digit year-over-year growth in revenue and operating income.

In addition, having multiple commercial products allows the company to diversify its sources of free cash flow as well as reduce the financial risk associated with the loss of exclusivity of some of its flagship medicines over the next six years.

Source: Author's elaboration, based on 10-K filing.

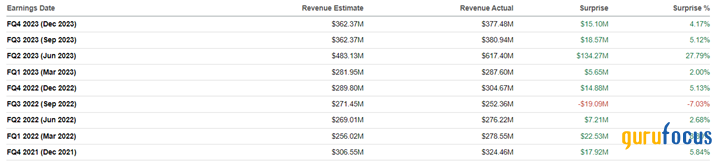

On Feb. 15, Alkermes published financial results for the fourth quarter of 2023, which pleasantly surprised us despite the increased competition in the schizophrenia drugs market. Key factors that contributed to the successful development of the company's business are the continued increased demand for Lybalvi and Vivitrol, as well as growth in sales of products commercialized by its partners, including mastodons of the health care sector, such as Johnson & Johnson (NYSE:JNJ) and Biogen (NASDAQ:BIIB).

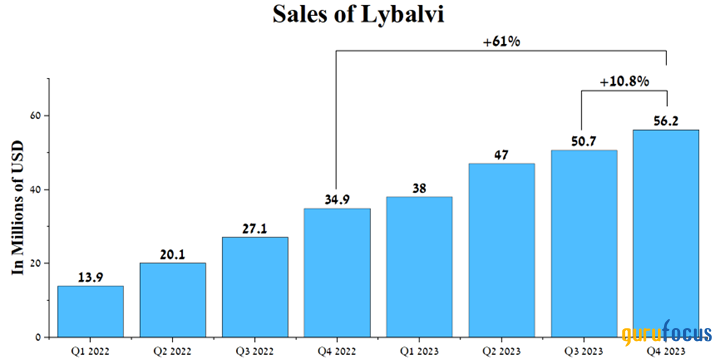

In addition to Vivitrol, which will be discussed in more detail later, we also highlight Lybalvi (olanzapine and samidorphan). It is an FDA-approved medicine for the treatment of patients with schizophrenia and bipolar I disorder.

According to the World Health Organization, schizophrenia is one of the most common brain disorders, affecting about 24 million people worldwide. In comparison, the prevalence of bipolar I disorder in the U.S. is about 1%.

Lybalvi sales were $56.20 million, up 61% year over year, mainly due to its superior efficacy relative to competitors in the treatment of bipolar disorder.

Source: Author's elaboration, based on quarterly securities reports.

We believe this positive trend will continue in the coming years, thanks to the publication of the results of the Phase 3 open-label extension study, which assessed the efficacy and safety profile of Lybalvi in 523 participants.

So in a group of people with schizophrenia or bipolar I disorder who took Alkermes' product for up to four years, there was minimal change in their body weight, LDL cholesterol and HbA1c and, more importantly, it was able to demonstrate its ability to stabilize the symptoms associated with these mental disorders.

As such, we initiate our coverage of Alkermes with an outperform rating for the next 12 months.

Fourth-quarter financial results and outlook for 2024

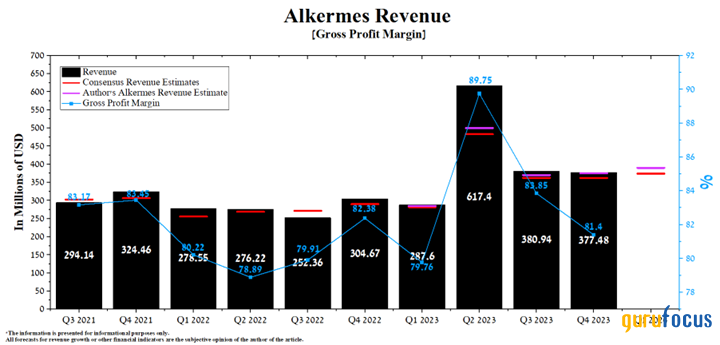

Alkermes' revenue for the fourth quarter of 2023 was about $377.50 million, up 23.90% year over year. Just as importantly, it beat our expectations by about $3 million.

Additionally, actual revenue beat analysts' consensus estimates in eight of the last nine quarters, indicating analysts continue to underestimate the business prospects of Alkermes' FDA-approved medicines and those products developed using its technology.

Source: Author's elaboration, based on analyst data.

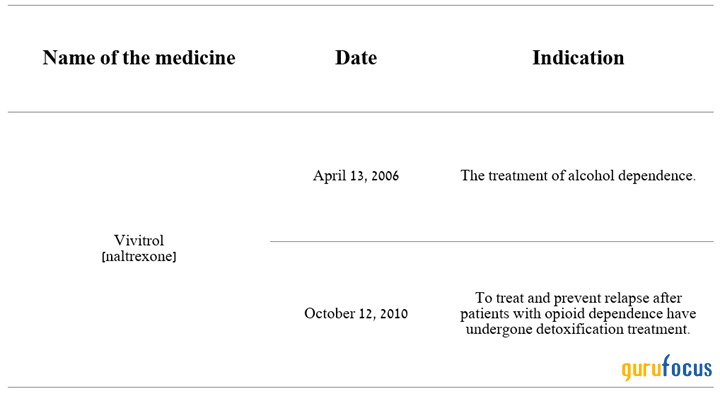

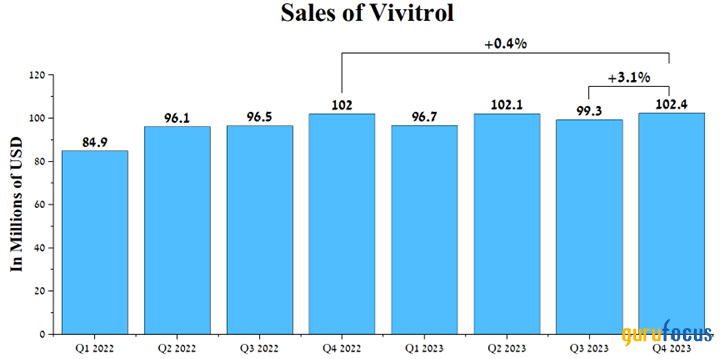

Besides Lybalvi, another significant contributor to the company's financial recovery is Vivitrol (naltrexone), a pure opiate receptor antagonist that received its first FDA approval in 2006 for the treatment of alcohol dependence. Four years later, it was approved to help treat opioid abuse disorder.

Source: Author's elaboration, based on Alkermes press releases.

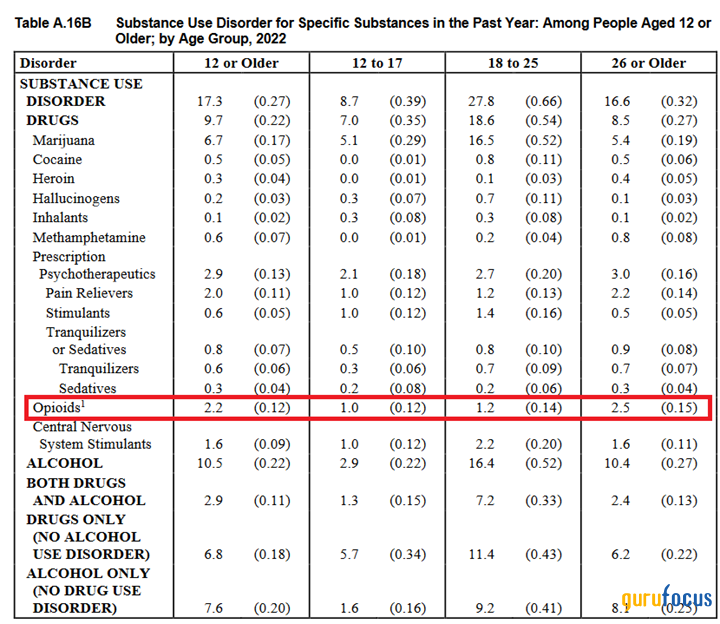

According to the Substance Abuse and Mental Health Services Administration (SAMHSA), approximately 6.10 million people aged 12 years and older were affected by opioid addiction in 2022.

Source: Author's elaboration, based on SAMHSA data.

In recent years, there has been a steady upward trend in the number of Americans suffering from opioid use disorder, which is one of the main factors that will contribute to the growth in demand for Vivitrol, even in the face of increased competition with drugs such as Suboxone, Subutex, Brixadi and Zubsolv.

Total sales of Vivitrol were $102.40 million in the fourth quarter of 2023, an increase of 3.10% from the prior quarter, primarily due to growth in prescriptions.

Source: Author's elaboration, based on quarterly securities reports.

We forecast demand for this medicine will be stable in the long term until generic versions are introduced to the market, first by Teva Pharmaceutical (NYSE:TEVA) in 2027 and then by Amneal Pharmaceuticals (NASDAQ:AMRX) in 2028.

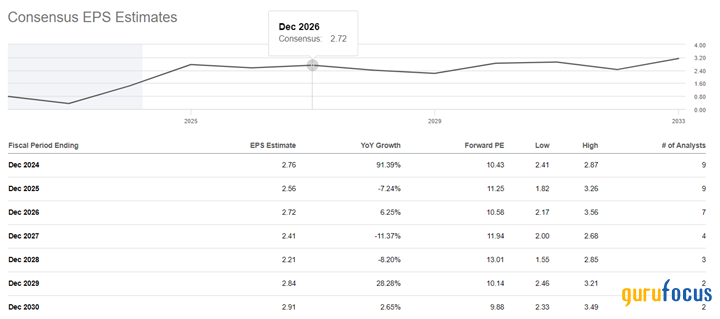

On April 25, the company will publish financial results for the first quarter of 2024. According to analysts, Alkermes' revenue for the period is anticipated to range from $354.20 million to $415.01 million, up 30.40% from the previous year.

Source: Author's elaboration, based on GuruFocus data.

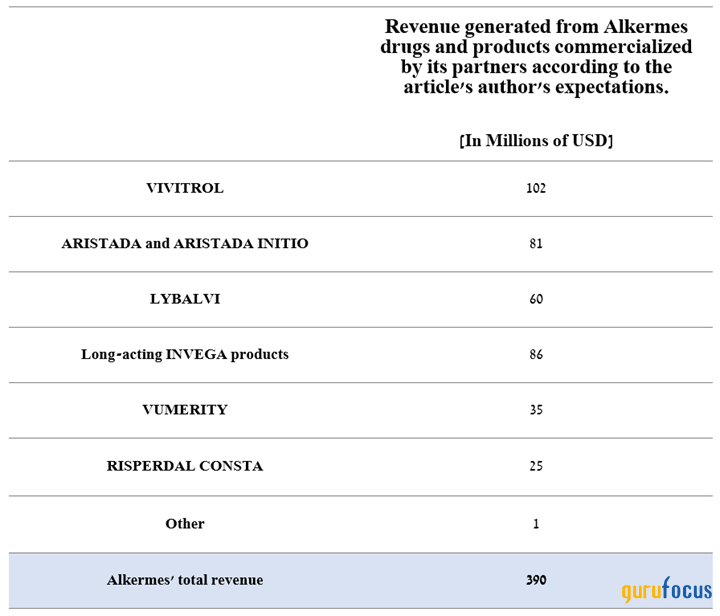

However, our model projects its total revenue to reach $390 million, which is about $15.90 million above the median of the above range, mainly due to a more positive outlook for sales of Lybalvi, Aristada as well as long-acting Invega products, which are commercialized by Johnson & Johnson.

Source: Created by author.

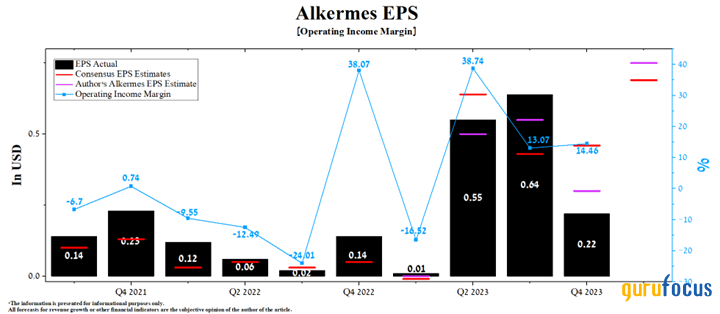

Alkermes' operating income margin was about 14.50% for the fourth quarter of 2023, up 1.39% quarter over quarter, primarily due to strong growth in demand for its drugs.

According to our estimates, this financial metric will reach 19.20% in 2024 and increase to 27.10% by 2025, mainly due to increased manufacturing and royalty revenues, lower costs of raw materials required for the synthesis of its products, optimization of marketing costs, as well as increasing demand for Lybalvi, which is rapidly gaining share in the global antipsychotic drug market.

On the other hand, analysts forecast Alkermes' first-quarter earnings per share to range from 58 cents to 92 cents, an increase of 12.80 times year over year. Meanwhile, according to our model, the company's earnings per share will be 6 cents above the median of this range and reach 75 cents.

Source: Author's elaboration, based on GuruFocus data.

After the end of the acute phase of Covid-19, Alkermes' financial position continues to recover actively. As a result, the trailing 12-month non-GAAP price-earnings ratio was 19.51, which is 57.40% lower than the average over the past five years.

On a more global scale, the company's operating income is expected to continue growing over the next three years, causing its price-earnings ratio to fall to 10.58 by 2026. We believe this multiplier value significantly below the sector median will be particularly attractive to long-term investors seeking pharmaceutical companies with a robust pipeline of FDA-approved and experimental next-generation medicines being developed to treat various common mental disorders.

Source: Author's elaboration, based on analyst data.

Conclusion

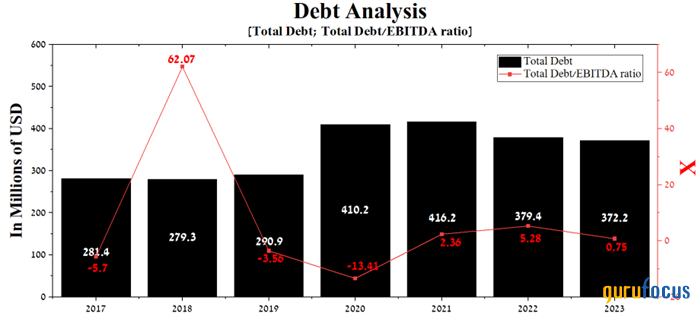

As a fast-growing pharmaceutical company, the main risks that may negatively affect the investment attractiveness of Alkermes and which must first be taken into account by financial market participants are the decline in sales of Vivitrol from 2027 due to the launch of its generic versions, increased competition in the global schizophrenia drugs market as well as the negative impact of President Biden's Inflation Reduction Act.

However, despite the risks described above, the company has relatively low multiples and high gross margin relative to its competitors. At the same time, thanks to the growing demand for Lybalvi and Aristada, its total debt/Ebitda ratio has decreased significantly in recent quarters and amounted to 0.75 at the end of 2023.

Source: Author's elaboration, based on GuruFocus data.

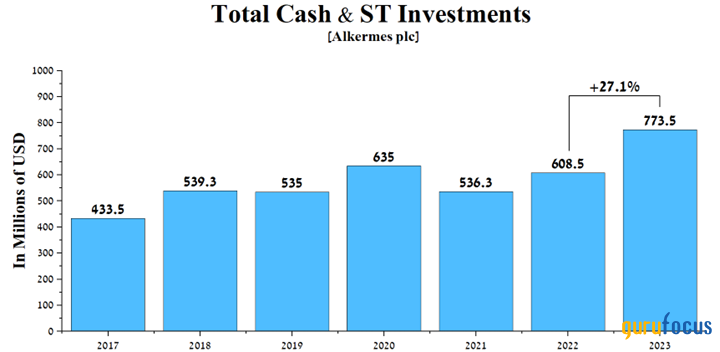

The company also has an extensive portfolio of experimental drugs that continue to demonstrate high efficacy in the treatment of narcolepsy, schizophrenia and bipolar I disorder, which, coupled with its growing total cash and short-term investments, are factors that make Alkermes an attractive asset for long-term investors.

Source: Author's elaboration, based on GuruFocus data.

We initiate our coverage of Alkermes with an outperform rating for the next 12 months.

This article first appeared on GuruFocus.

Yahoo Finanzen

Yahoo Finanzen