Independent Bank Corp (Ionia MI) Reports Q1 2024 Earnings: Surpasses Analyst Projections

Net Income: $16.0 million, up 23.1% from $13.0 million in Q1 2023, exceeding estimates of $13.67 million.

Earnings Per Share (EPS): $0.76 per diluted share, a 24.6% increase from $0.61 in Q1 2023, surpassing the estimate of $0.64.

Revenue: Net interest income of $40.2 million, up 4.6% year-over-year, aligning closely with the estimated revenue of $40.28 million.

Dividend: Paid a quarterly dividend of $0.24 per share on common stock in February 2024.

Loan Growth: Net growth in loans of $49.1 million, marking a 5.3% annualized increase from the end of 2023.

Core Deposits: Increased by $95.7 million, or 9.0% annualized, from December 31, 2023.

Net Interest Margin: Expanded to 3.30% from 3.26% on a linked quarter basis.

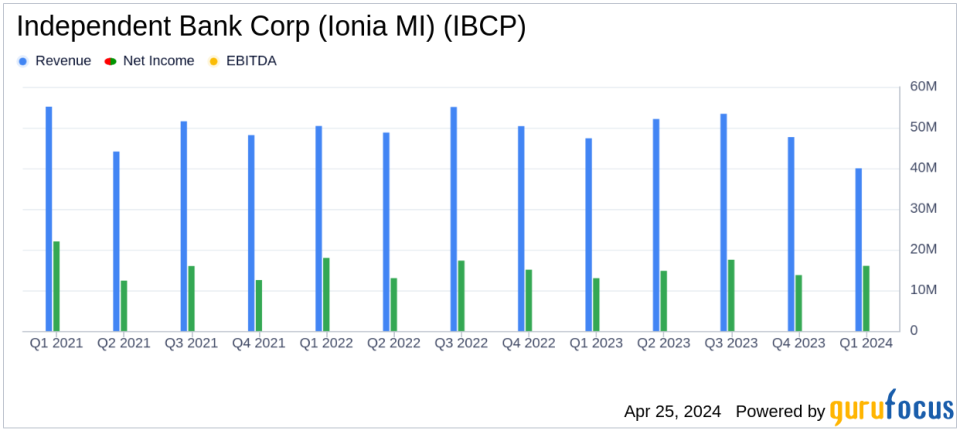

On April 25, 2024, Independent Bank Corp (Ionia MI) (NASDAQ:IBCP) announced its first quarter results for 2024, showcasing significant growth in key financial metrics and surpassing analyst expectations. The detailed earnings can be viewed in their latest 8-K filing. The company reported a net income of $16.0 million, or $0.76 per diluted share, compared to the estimated $13.67 million and $0.64 per share, respectively. This represents a substantial increase from the $13.0 million, or $0.61 per diluted share, recorded in the same quarter the previous year.

Independent Bank Corp (Ionia MI), a commercial bank headquartered in Grand Rapids, Michigan, offers a comprehensive range of banking services. These include commercial lending, direct and indirect consumer financing, mortgage lending, as well as innovative online and mobile banking solutions for both individual and corporate clients.

Financial Performance and Growth

The bank's performance this quarter reflects a robust growth trajectory, with a 23.1% increase in net income and a 24.6% rise in diluted earnings per share year-over-year. Notably, tangible book value per share also grew by 15.7%. This financial growth was supported by a 9.0% annualized increase in core deposits and a 5.3% rise in loan growth since the end of 2023.

President and CEO, William B. Kessel, highlighted the expansion of the net interest margin to 3.30% from 3.26% in the previous quarter, alongside controlled expenses and strong credit metrics. Kessel expressed optimism about sustaining positive growth trends through the ongoing fiscal year and into 2025.

Income Statement Insights

The company's net interest income saw a 4.6% increase from the previous year, totaling $40.2 million. Non-interest income also rose to $12.6 million, primarily due to gains in mortgage banking. Despite these positives, non-interest expenses saw a slight increase to $32.2 million. The provision for credit losses decreased significantly to $0.7 million from $2.2 million in the prior year's first quarter, reflecting improved asset quality.

Balance Sheet and Capital Strength

As of March 31, 2024, total assets slightly decreased to $5.23 billion. The loan portfolio grew to $3.84 billion, with deposits totaling $4.58 billion. The bank's capital ratios remain strong, with Tier 1 capital to average total assets at 9.05%, indicating a well-capitalized status. Shareholders' equity increased to $415.6 million, up from $404.4 million at the end of 2023, driven largely by retained earnings.

Asset Quality and Risk Management

The asset quality of Independent Bank Corp (Ionia MI) has shown improvement with a decrease in non-performing loans to $3.69 million from $5.23 million at the end of 2023. The ratio of non-performing loans to total portfolio loans stood at a healthy 0.10%, reflecting the bank's effective risk management strategies.

In conclusion, Independent Bank Corp (Ionia MI)'s first quarter results for 2024 indicate a strong financial position and promising growth prospects. The bank's ability to exceed analyst expectations while maintaining robust asset quality and capital adequacy positions it well for future performance.

Investor and Analyst Communications

The details of the earnings were discussed in a conference call led by senior management, emphasizing the strategic initiatives driving the bank's performance. The replay of this call is available for those interested in deeper insights into the bank's operational strategies and financial results.

For more detailed information on Independent Bank Corp (Ionia MI)'s financial performance, please visit their website at IndependentBank.com.

Explore the complete 8-K earnings release (here) from Independent Bank Corp (Ionia MI) for further details.

This article first appeared on GuruFocus.

Yahoo Finanzen

Yahoo Finanzen