Here's Why Vertiv Holdings Co (NYSE:VRT) Has Caught The Eye Of Investors

It's common for many investors, especially those who are inexperienced, to buy shares in companies with a good story even if these companies are loss-making. Sometimes these stories can cloud the minds of investors, leading them to invest with their emotions rather than on the merit of good company fundamentals. While a well funded company may sustain losses for years, it will need to generate a profit eventually, or else investors will move on and the company will wither away.

If this kind of company isn't your style, you like companies that generate revenue, and even earn profits, then you may well be interested in Vertiv Holdings Co (NYSE:VRT). Even if this company is fairly valued by the market, investors would agree that generating consistent profits will continue to provide Vertiv Holdings Co with the means to add long-term value to shareholders.

View our latest analysis for Vertiv Holdings Co

How Fast Is Vertiv Holdings Co Growing Its Earnings Per Share?

Strong earnings per share (EPS) results are an indicator of a company achieving solid profits, which investors look upon favourably and so the share price tends to reflect great EPS performance. So for many budding investors, improving EPS is considered a good sign. It is awe-striking that Vertiv Holdings Co's EPS went from US$0.31 to US$1.08 in just one year. While it's difficult to sustain growth at that level, it bodes well for the company's outlook for the future. But the key is discerning whether something profound has changed, or if this is a just a one-off boost.

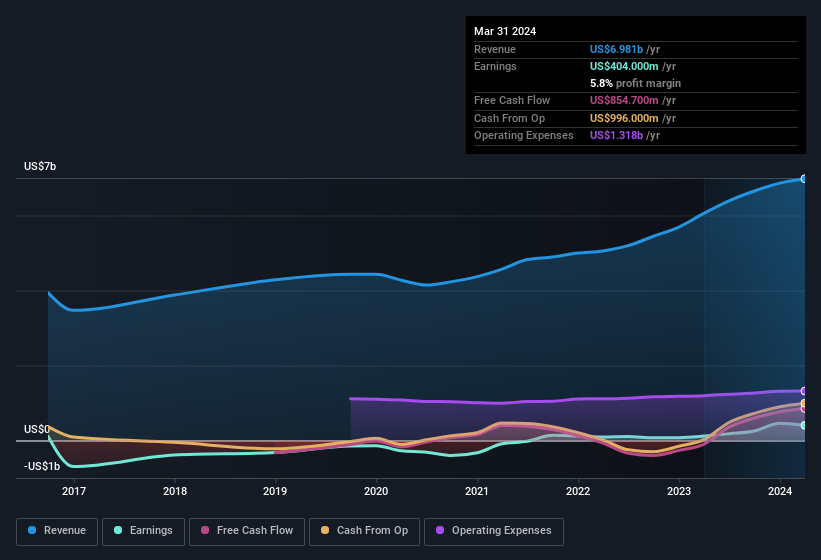

One way to double-check a company's growth is to look at how its revenue, and earnings before interest and tax (EBIT) margins are changing. The good news is that Vertiv Holdings Co is growing revenues, and EBIT margins improved by 7.1 percentage points to 14%, over the last year. Ticking those two boxes is a good sign of growth, in our book.

In the chart below, you can see how the company has grown earnings and revenue, over time. Click on the chart to see the exact numbers.

While we live in the present moment, there's little doubt that the future matters most in the investment decision process. So why not check this interactive chart depicting future EPS estimates, for Vertiv Holdings Co?

Are Vertiv Holdings Co Insiders Aligned With All Shareholders?

We would not expect to see insiders owning a large percentage of a US$36b company like Vertiv Holdings Co. But thanks to their investment in the company, it's pleasing to see that there are still incentives to align their actions with the shareholders. Notably, they have an enviable stake in the company, worth US$365m. This suggests that leadership will be very mindful of shareholders' interests when making decisions!

While it's always good to see some strong conviction in the company from insiders through heavy investment, it's also important for shareholders to ask if management compensation policies are reasonable. Our quick analysis into CEO remuneration would seem to indicate they are. For companies with market capitalisations over US$8.0b, like Vertiv Holdings Co, the median CEO pay is around US$14m.

The Vertiv Holdings Co CEO received total compensation of just US$6.2m in the year to December 2023. That's clearly well below average, so at a glance that arrangement seems generous to shareholders and points to a modest remuneration culture. CEO remuneration levels are not the most important metric for investors, but when the pay is modest, that does support enhanced alignment between the CEO and the ordinary shareholders. It can also be a sign of good governance, more generally.

Does Vertiv Holdings Co Deserve A Spot On Your Watchlist?

Vertiv Holdings Co's earnings per share have been soaring, with growth rates sky high. An added bonus for those interested is that management hold a heap of stock and the CEO pay is quite reasonable, illustrating good cash management. The drastic earnings growth indicates the business is going from strength to strength. Hopefully a trend that continues well into the future. Vertiv Holdings Co is certainly doing some things right and is well worth investigating. You should always think about risks though. Case in point, we've spotted 2 warning signs for Vertiv Holdings Co you should be aware of.

Although Vertiv Holdings Co certainly looks good, it may appeal to more investors if insiders were buying up shares. If you like to see companies with more skin in the game, then check out this handpicked selection of companies that not only boast of strong growth but have strong insider backing.

Please note the insider transactions discussed in this article refer to reportable transactions in the relevant jurisdiction.

Have feedback on this article? Concerned about the content? Get in touch with us directly. Alternatively, email editorial-team (at) simplywallst.com.

This article by Simply Wall St is general in nature. We provide commentary based on historical data and analyst forecasts only using an unbiased methodology and our articles are not intended to be financial advice. It does not constitute a recommendation to buy or sell any stock, and does not take account of your objectives, or your financial situation. We aim to bring you long-term focused analysis driven by fundamental data. Note that our analysis may not factor in the latest price-sensitive company announcements or qualitative material. Simply Wall St has no position in any stocks mentioned.

Yahoo Finanzen

Yahoo Finanzen