Nikkei 225

37.168,69 -911,01 (-2,39%) Dow Jones 30

37.775,38 +22,07 (+0,06%) Bitcoin EUR

58.417,41 +669,25 (+1,16%) CMC Crypto 200

1.278,85 +393,31 (+42,84%) Nasdaq Compositive

15.601,50 -81,87 (-0,52%) S&P 500

5.011,12 -11,09 (-0,22%)

Intel Corporation (INTC)

Nachbörse:

| Kurs Vortag | 35,68 |

| Öffnen | 35,42 |

| Gebot | 35,03 x 100 |

| Briefkurs | 35,05 x 1200 |

| Tagesspanne | 34,77 - 35,66 |

| 52-Wochen-Spanne | 26,86 - 51,28 |

| Volumen | |

| Durchschn. Volumen | 48.503.000 |

| Marktkap. | 149,161B |

| Beta (5 J., monatlich) | 1,01 |

| Kurs-Gewinn-Verhältnis (roll. Hochrechn.) | 87,60 |

| EPS (roll. Hochrechn.) | 0,40 |

| Gewinndatum | 25. Apr. 2024 |

| Erwartete Dividende & Rendite | 0,50 (1,43%) |

| Ex-Dividendendatum | 06. Feb. 2024 |

| 1-Jahres-Kursziel | 41,90 |

PR Newswire

PR NewswireMiTAC bringt revolutionäre Serverlösungen auf den Markt, die mit Intel® Xeon® Scalable-Prozessoren der 5. Generation und Intel Data Center GPUs beschleunigt werden

MiTAC Computing Technology, eine Tochtergesellschaft der MiTAC Holdings Corp. (TSE:3706), präsentiert stolz eine bahnbrechende Suite von Serverlösungen, die unübertroffene Fähigkeiten mit den Intel® Xeon® Scalable-Prozessoren der 5. Generation bieten. MiTAC stellt seine hochmodernen Signaturplattformen vor, die die Intel® Data Center GPUs der Intel® Max Series und der Intel® Flex Series nahtlos integrieren und so einen beispiellosen Leistungssprung für HPC- und KI-Anwendungen ermöglichen.

Bloomberg

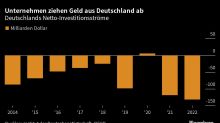

BloombergScholz stemmt sich bei Siemens-Termin gegen Deindustrialisierung

(Bloomberg) -- Bundeskanzler Olaf Scholz bietet sich angesichts anhaltender Kapitalabflüsse aus Deutschland und schleichender Deindustrialisierung eine goldene Gelegenheit, die Werbetrommel für den Standort zu rühren: Die Siemens AG, Europas größter Industriekonzern, stellt am heutigen Donnerstag eine neue Investition im Süden des Landes vor.Weitere Artikel von Bloomberg auf Deutsch:JPMorgan-Boss Jamie Dimon bestätigt Deutschland-PlanHelaba wirbt LBBW-Bankerin Tamara Weiss für den Vorstand anAb