Royalty-Free Sudoswap Is Finding Favor With NFT Traders

With all the regulatory news threatening fundamental tenets of DeFi, it’s easy to forget about NFTs.

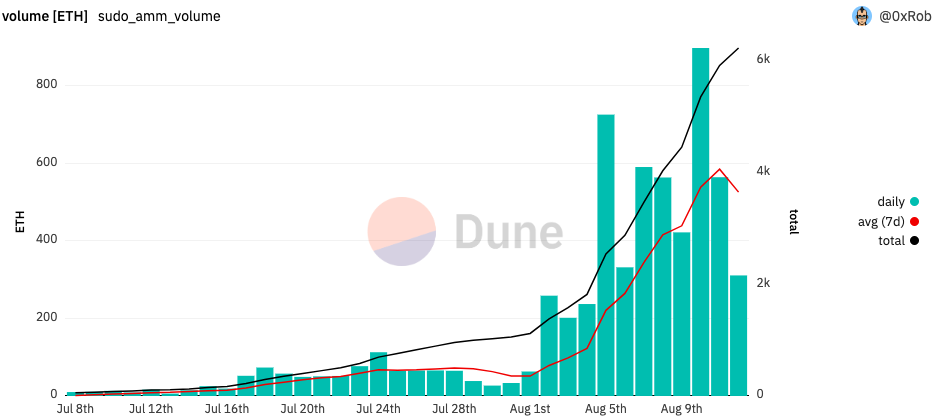

Not everyone has forgotten, however, as NFT traders pushed cumulative trading volume on sudoAMM, a recently launched NFT marketplace, over $10M on Aug. 11.

The milestone comes 35 days after the project was launched. In contrast, Coinbase’s NFT marketplace is yet to cross the $10M total volume mark — it’s at just $6.7M, 100 days after launching on May 4.

‘Real Yield’

Kofi Kufuor, a partner at crypto-focused investment firm 1confirmation, sees sudoAMM as bringing two major value propositions to the table.

Firstly, sudoAMM allows anyone to easily become a liquidity provider for NFTs and earn fees.

“It’s one of the few opportunities in DeFi and NFTs to earn ‘real yield,” Kufuor told The Defiant. Real yield is an emerging trend, denoting projects distributing fee revenue in mainstream tokens like ETH or stablecoins. This is a far cry from the triple-digit yields of DeFi past, which were largely denominated in a project’s inflationary governance token.

SudoAMM allows users to deposit a combination of NFTs from a single collection and ETH, along a specific price range called a bonding curve. They can then earn trading fees as other users swap NFTs for ETH or vice versa.

Efficient Pricing

The marketplace’s other value proposition is that sudoAMM’s design allows users to instantly sell their NFTs into a pool, Kufuor said.

SudoAMM’s model makes it so users can deploy a pool which will programmatically buy or sell an NFT at a given price, similar to limit orders. Users also have the option to sell NFTs immediately into a pool at a quoted price, rather than having to accept a bid like on OpenSea.

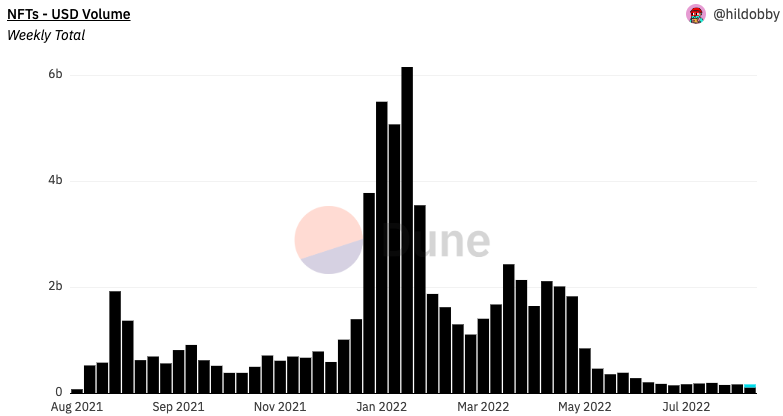

SudoAMM’s momentum is all the more impressive because it comes at a time when the bottom has fallen out of the NFT market — weekly volume has dropped from an all-time weekly high of $6B in January to under $200M weekly since mid-June.

Still, the protocol is small. SudoAMM currently has only 6,130 users.

Creator Fees

SudoAMM also doesn’t support royalty fees, which has spawned a controversy of its own.

SudoAMM’s design contrasts with marketplaces like OpenSea, which allows creators to turn on royalties.

It’s hard to argue with success though — SudoAMM facilitated 5.9% of total NFT trading volume on Aug. 10 — not bad for a project which launched just over a month ago.

Yahoo Finanzen

Yahoo Finanzen