Gold miners fall sharply as gold dips below key level

Shares of gold miners fell in Wednesday morning trade as gold dropped more than 1 percent to below its 50-day moving average, ahead of Fed Chair Janet Yellen's highly anticipated Friday speech.

"The decline in gold today in my mind was mostly technical," Kitco Senior Analyst Jim Wyckoff said.

"Also, the outside markets are in a bearish posture," he said, noting that crude oil prices were lower and the U.S. dollar index was higher.

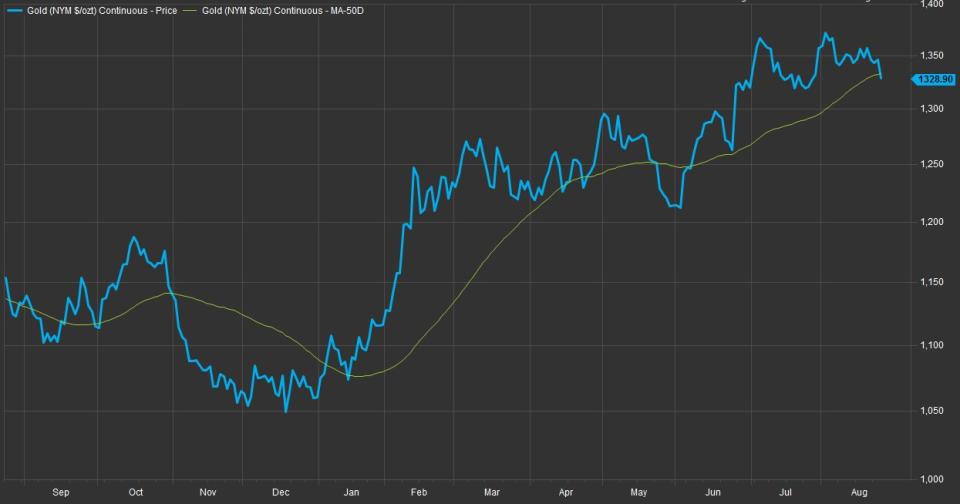

Gold futures (CEC:Commodities Exchange Centre: @GC.1) traded below their 50-day moving average of $1,333.70 an ounce for the first time since June 24. The last time gold closed below its 50-day moving average was June 7.

Source: FactSet

The VanEck Vectors Gold Miners ETF (GDX) (NYSE Arca: GDX) fell 7 percent to below its 50-day moving average of $29.09. The ETF closed just below that level on Tuesday for the first time since May 31. With Wednesday's declines, GDX saw its first four-day losing streak since early November.

Shares of the world's largest gold producer, Barrick Gold (ABX) (Toronto Stock Exchange: ABX-CA), fell more than 9 percent. Newmont Mining (NEM) was more than 7 percent lower,its worst day since July 20.

The shares of Direxion Daily Gold Miners Index Bull 3X Shares (NUGT) (NYSE Arca: NUGT) were more than 21 percent lower.

Shares of Glencore (London Stock Exchange: GLEN-GB) were also under pressure after the major commodities producer and trader said first-half adjusted profits fell 13 percent from the same period last year to $4 billion. The company did lower both the lower and upper end of its net debt target range by half a billion and said it was on track to sell assets. The stock closed 3 percent lower in London.

The U.S. dollar index was about a third of a percent higher Wednesday morning, tracking for solid weekly gains. Gold usually falls when the dollar strengthens.

Yellen is set to speak Friday at the central bank's annual conference in Jackson Hole, Wyoming. Her remarks will be scrutinized for indications on the timing of the next interest rate hike, but she is not expected to provide much detail.

—CNBC's Gina Francolla contributed to this report.

More From CNBC

Top News and Analysis

Latest News Video

Personal Finance

Yahoo Finanzen

Yahoo Finanzen